what does it mean to be tax deferred

Deferred tax liabilities and deferred tax assets. In this article we will see why a company may differ its tax to a subsequent fiscal year or why a company may choose to pay the tax in advance.

Nyc 1031 Exchange Rules In Nyc Hauseit Real Estate Terms Investing Capital Gains Tax

Gains on investments also called capital.

. Now that you know what tax deferral is and. November 26 2021 John Culpepper Comments Off on What Does Tax Deferred Mean. The main tax-deferred retirement accounts are the 401 k and the Individual Retirement Account IRA.

Some taxes can be deferred indefinitely while others may be taxed at a lower rate in the future. A tax deferral works like this. In other words tax deferral means that the payment of tax obligations is delayed or postponed to the future.

Tax deferred means that the tax that a person or company will need to pay on investments revenues or profits will be deferred to a future point in time. A deferred tax liability arises when a companys real-world tax bill is lower than what its financial statements suggest it should be due to differences between tax accounting rules and standard accounting practices. This allows assets to grow faster and reduces tax liability.

When a taxpayer is said to have deferred their taxes what it means is that they have put off the payment of their taxes until a later date in the future where it may be either taxed at a lower rate or deferred indefinitely. What Does Tax Deferred Mean. Why Does Tax Deferred Matter.

Investors should consider taking advantage of tax-deferred accounts whenever available. Common examples of tax-deferred income fall into two broad categories. What Does Tax Deferred Mean.

Tax deferral is when taxpayers delay paying taxes to some point in the future. The taxpayer puts the funds in a tax deferred account such as an income account. While tax deferral does help you grow your assets quicker that isnt the point.

The term deferred tax refers to a tax which shall either be paid in future or has already been settled in advance. Tax deferral is a tax-strategy that pushes out the due date on taxes for gains on an investment. This poems meaning is only recognized when the title is read again after reading the poem.

Deferred tax can fall into one of two categories. What does the title A Dream Deferred mean. Perhaps the most common example of tax-deferred growth is that which youll.

Tax deferred normally means that you will not pay a tax now but will later. Deferred income taxes impact the future cash flow of the Company ie if its an asset the cash outflow will be less and if its a. It goes without saying that nobody is a fan of paying taxes and if given a choice most people would hold off forking over the money for as long as humanly possible.

Tax-deferred accounts allow investments to grow tax-free until some point in the future sometimes indefinitely. Employer F initially deferred the employers employers filing of 1500 in social security tax under section 2302 of the CARES Act. The two most popular kinds of these deferred investments are found in IRAs and tax deferred annuities.

Remember tax deferral means taxes are assessed but payment is delayed. Having a bunch of money is nice but having significantly greater retirement income is really what this is all about and actually much more important. This includes dividends interest and capital gains which are allowed to accumulate without taxes paid until the owner withdraws the earnings and gains.

Tax exempt means taxes are never assessed on the investment in the first place. With deferred payments vendors and customers typically come to an agreement ie a deferred payment agreement that lets the customer take possession of an item now and pay the cost at a later date. Depending on the agreement deferred payments may come with interest too and well get to that later.

Deferred Income Tax. Deferred tax is a balance sheet line item which is recorded because the Company owes or pay more tax to the authorities. Harlem also named Dream Deferred is a simple but meaningful poem by the wonderful Langston Hughes.

An annuity is an investment vehicle that combines features of insurance and investment and can provide tax-deferred growth. The deferred tax represents the negative or positive amounts of tax owed by the Company. The two main types of tax-deferred benefits for American taxpayers are some annuities and some retirement accounts.

Both will appear as entries on a balance sheet and represent the negative and positive amounts of tax owed. The account holder is not liable for taxes until funds are. Adjective not taxed until sometime in the future.

The first is income in certain retirement accounts. Tax-Deferred Income Any income that one earns but does not receive until a later date resulting in a situation in which taxes on the income are not paid until later. The amount represents money the business will eventually owe to the government so it is a.

Because income tax expense is more than income tax payable the 10000 is a deferred tax liability. Most companies normally prepare an income statement and a tax statement every. Tax deferred money and status pertains to earnings on investments.

Note that there can be one without the other - a company can have only deferred tax liability or deferred tax assets. It is important to note that tax deferred is not the same as tax exempt which refers to the absence of applicable taxes. This temporarily results in a remaining federal deposit requirement of 7500.

Its a liability because the 10000 represents income taxes that will be payable in the future after the temporary depreciation difference evens out. Employer F then reduces this federal tax liability by 3500 for eligible sickness benefits leaving a federal deposit obligation of. What Does Tax Deferred Mean.

The IRS will want its share of that gain through taxes. For example if you purchase a property for 300000 and five years later sell it for 350000 the gain will be 50000. Nothing is certain except death and taxes.

Tax deferral is a powerful way to increase your retirement income. Tax-deferred growth is investment growth thats not subject to taxes immediately but is instead taxed down the line. Thus the tax liability is.

For example if you invest in a. Tax-deferred status refers to investment earnings such as interest dividends or capital gains that accumulate tax free until the. The good news is that there is a way to put off the inevitable and.

A deferred income tax is a liability recorded on the balance sheet that results from a difference in income recognition between tax laws and accounting methods.

Savvy Tax Withdrawals Fidelity Lifetime Income Saving For Retirement Social Security Benefits

Finance Primerica Definition Irs What Is A Ira Definition Individual Retirement Accoun Individual Retirement Account Personal Finance Retirement Accounts

Deferred Tax Meaning Accounting Class

Tax Accounting Meaning Pros Components And More In 2022 Accounting Deferred Tax Financial Accounting

401 K S Iras Tax Deferred Vs Tax Exempt Investing Investing Ira Investment Advice

Budget Impact On Income Tax Income Tax Budgeting Tax

Deferred Tax Liabilities Meaning Example Causes And More Deferred Tax Accounting Education Accounting Basics

1031 Exchange Tips Hauseit Capital Gains Tax Real Estate Terms Capital Gain

Those Who Suggest Doctors In Their Peak Earnings Years Should Make Roth 401 K Contributions Do Roth Conversions Or Worse Avoid Tax De Tax Boredom Cure Roth

If You Are New To Business Or Investing Generational Wealth Is The Book For You The Book Begins With Inspirational Wo Investing Tax Money Economic Development

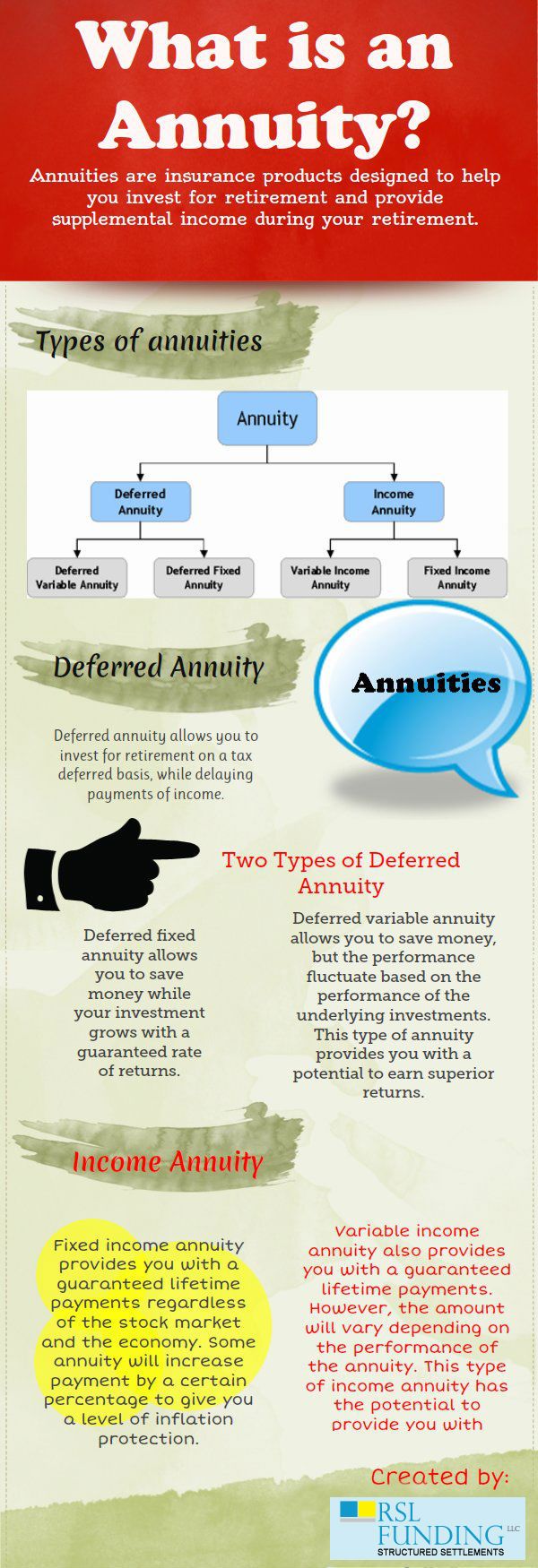

What Is An Annuity Investing For Retirement Annuity Finance Investing

Finance With Gerald Dewes When Must Taxes Be Paid On Ira And Employer Sponsored Retirement Funds Retirement Fund Tax Deductions Traditional Ira

Financial Consolidation Deferred Tax Liability Ifrs10 Fccs Basics Deferred Tax Company Financials Intangible Asset

If You Are Worried About Paying For Retirement It Is Worth Evaluating The Pros And Cons Of Annuities Variable Annuities Annuity Annuity Quotes

Your Tax Refund How Will You Spend It Infographic Tax Refund Finance Investing Ira Investment

What Is A Traditional Ira Traditional Ira Investing Tax Money

New Irs And Ftb Requirements On 1031 Tax Deferred Exchanges 2014 Www Westcoastescrow Com Escrow Escrow101 Propertytaxes Home Escrow Irs Home Selling Tips

Take Advantage Of The Window Of Opportunity Between Accumulation And Distribution In Retirement Use Partial Roth Convers Conversation Deferred Tax How To Plan

Tax Guide For Rental Investments Side 1 Tax Guide Investing Rental